Budgeting for Medicare

Revised on January 31, 2023

Overview of Costs

Medicare consists of “Original Medicare” known as Part A and Part B, plus any Medicare insurance plans you may elect to enroll in, like a Medicare Advantage plan (also known as “Part C”), Medicare Supplement plan, and/or a Prescription Drug Plan (also known as “Part D”).

When budgeting for Medicare, there are key costs to consider like monthly premiums, out-of-pocket costs (like coinsurance, co-pays and deductibles, and extra income-related charges and/or late enrollment penalties if applicable.

Read on to get an overview of the different types of monthly Medicare premiums and other costs to consider, helping you budget for Medicare.

Medicare Part A (Hospital Insurance) is premium-free if you or your spouse paid Medicare taxes for at least ten years (40 quarters). Most people qualify for premium-free Part A. If you don’t qualify for premium-free Part A, you may pay up to $506 per month for it in 2023 (up to $499 per month in 2022).

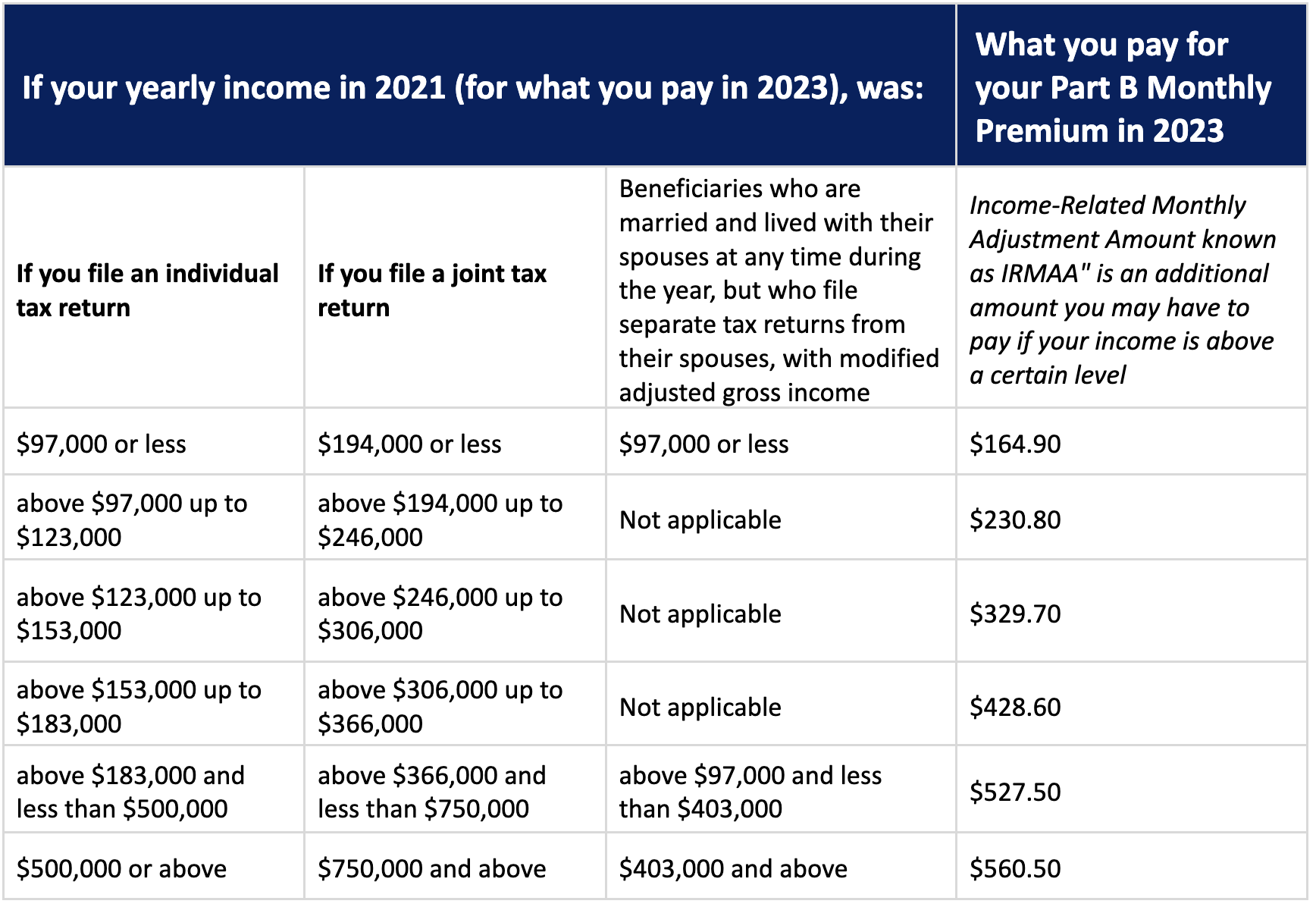

Medicare Part B (Medical Insurance) has a standard monthly premium amount of $164.90 in 2023 ($170.10 in 2022) but is higher depending on your income due to an “Income Related Monthly Adjustment Amount” known as “IRMAA”. IRMAA is an extra charge added to your monthly Part B premium. Medicare determines if you own an IRMAA based on the income you reported on your IRS tax return from 2 years ago. IRMAA also applies to “Part D” if you have a stand-alone prescription drug plan. 2022 income thresholds for Part B are:

Medicare Part B Deductible is $226 in 2023 (down from $233 in 2022). This deductible may not apply depending on which Medicare insurance plan you are enrolled in.

Medicare Insurance Plans help cover gaps in Original Medicare. The main types of Medicare Insurance plan types are:

- Medicare Advantage Plans (also known as “Part C”) – These plan premiums can range from $0 per month to approximately $120 per month or more depending on the plan and region.

- Medicare Supplement Plan (also known as “Medigap”) – These plan premiums can range from approximately $50 per month to $300 or more per month depending on the plan and region.

- Prescription Drug Coverage (also known as “Part D”) – These plan premiums can range from approximately $4.50 per month to $130 per month or more depending on the plan and region.

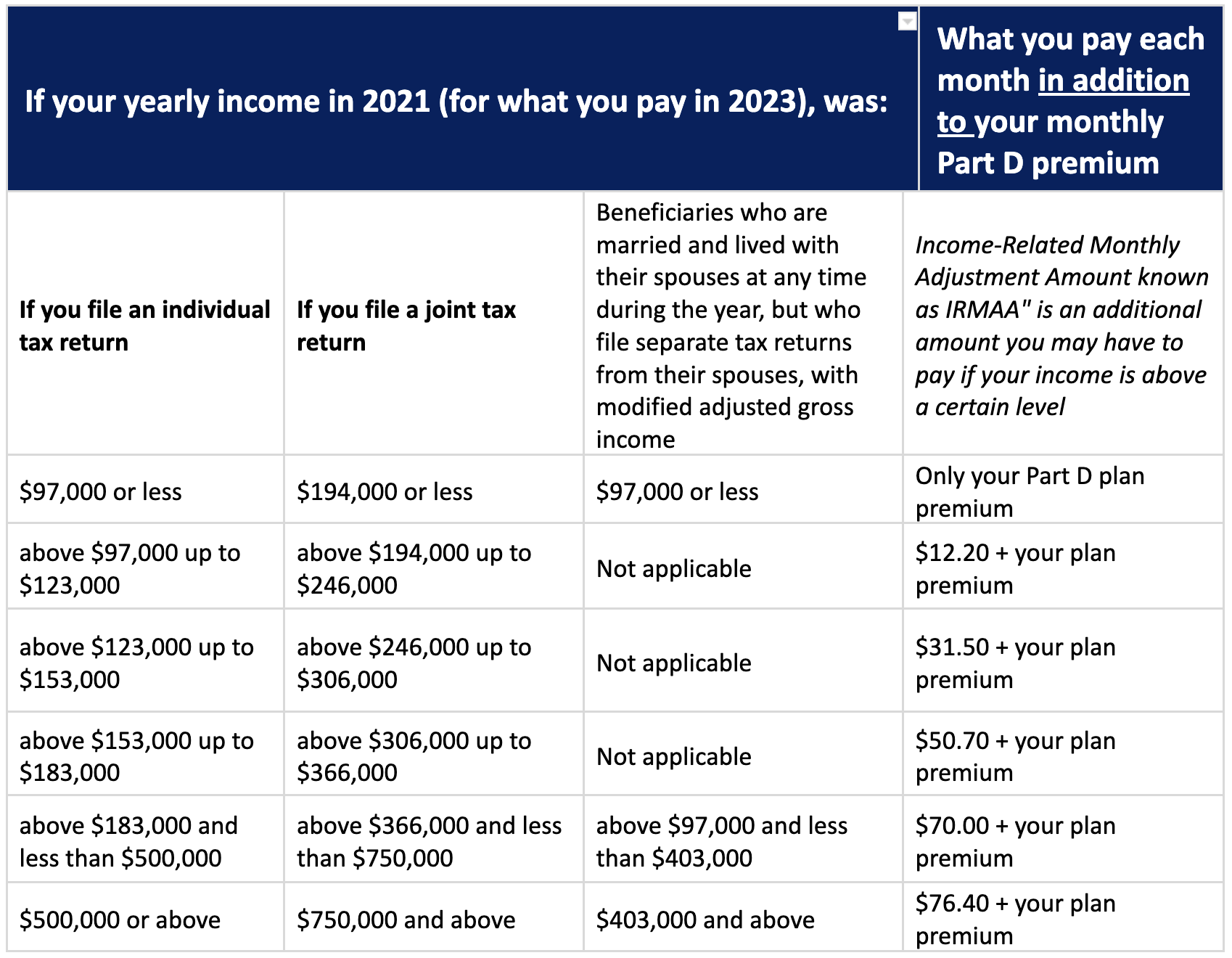

Your monthly premiums will depend on which plan(s) you elect to enroll. Note that you can enroll in a Medicare Advantage plan or a Medicare Supplement plan, but not both. If you enroll in a stand-alone prescription drug plan or if Part D is included in a Medicare Advantage plan, IRMAA may apply. IRMAA is an extra charge that is added to your monthly prescription drug plan premium (and Part B monthly premium as applicable). 2023 income thresholds for Part D are:

Out-of-pocket expenses vary by plan type and are in addition to your premium. Be sure to review what is covered under “Original Medicare” (Part A & Part B) and your Medicare Insurance plan summary carefully to get a better understanding of what types of out-of-pocket expenses may apply such as co-insurance, co-pays, and deductibles.

Late Enrollment Penalties may apply if you don’t enroll in Medicare Part B when you are first eligible or during a special enrollment period if applicable to your situation, your monthly premium may go up 10% of the standard premium for each full 12-month period that you could have had Part B but didn’t sign up for it. A late enrollment penalty also applies to Part D (prescription drug coverage) if you go without “creditable prescription drug coverage” 63-days in a row after your initial enrollment period is over. Medicare calculates the penalty by multiplying 1% of the “national base beneficiary premium”, $31.50 in 2023 ($33.37 in 2022), times the number of full, uncovered months you didn’t have Part D or creditable coverage. The monthly premium is rounded to the nearest $0.10 and added to your monthly Part D premium. The national base beneficiary premium may change each year, so your penalty amount may also change each year.